Very quickly, people that learn about these incentives realize that what they have heard so far, is likely true. After all, houses are going up everywhere (163, 836 houses in 2023 alone hia.com.au). The money must be coming from somewhere & most of these people are very unlikely to have saved up $200,000, considering how hard it is!

“There must be another way – but how??”

YOUR BLUEPRINT

If you’ve been paying attention, you’ll realise this too. There surely must be another way. Coincidentally, that leads us to the second reason why people never get ahead with their financials?

(There are 20 million people in Australia & I have spoken to hundreds – or maybe thousands i.e. a small portion of everyone. So, I am obviously generalising below.. but still)

Simple. It’s the same reason you don’t get ahead with other things too. Clarity. Like me, with other areas of my life, people don’t know what to do next. Whilst I am no expert in all of that “life stuff” – With financials, I can help with getting clearer. Here, we show you how you can use the financial and tax system of the government to get ahead – with property investments mostly.

The blueprint that we had? It used to throw people off. So, after a number of consultation, we have split it in two. (Yes – this stuff is complicated, that’s why you have accountants like us doing the heavy lifting for people like you)

(Of course, it’s true – the stories you have heard about Millionaires paying little to no tax, as you can tell below – thankfully everyone knows this to be true now)

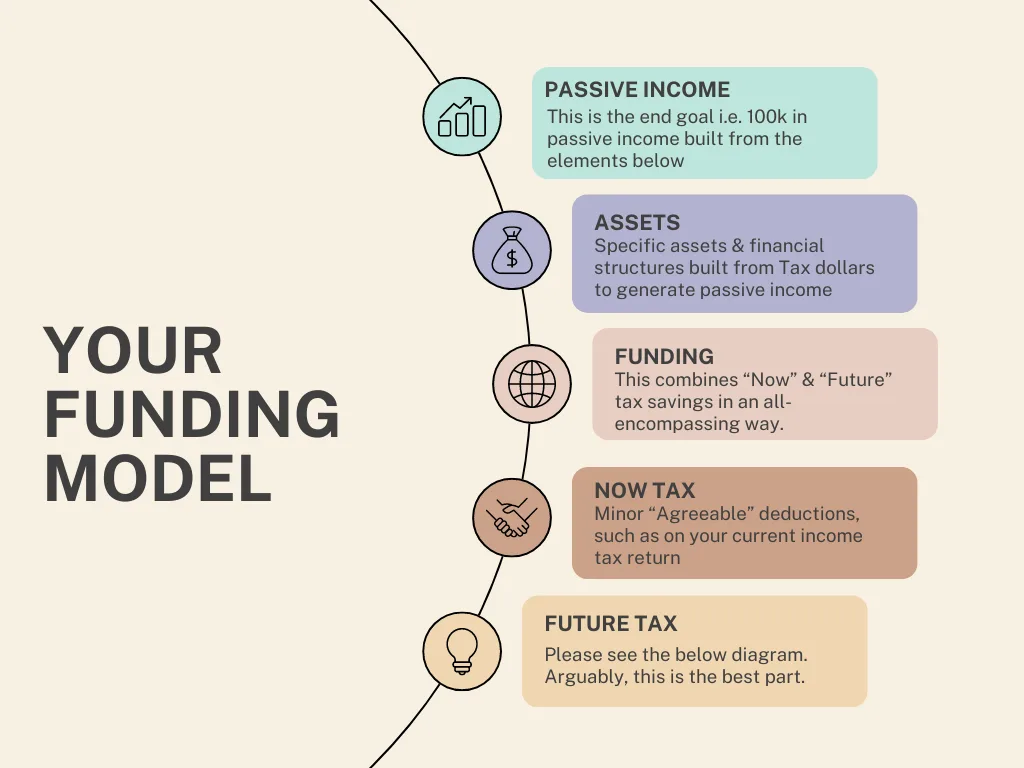

DIAGRAM 1 – BELOW: The first part shows the basic funding model, that gets you the money to fund your wealth creation efforts. i.e. where will the $$ come from – instead of just savings.

(NOTE: Why do we keep yapping about passive income? Well, odds are you have a job – how else are you going to grow your wealth? Because there are only two options, build your wealth & passive income OR start a business)

DIAGRAM 2: Further BELOW: The second part gets into the guts of the funding engine itself i.e. what you need to set up potentially.

Have you thought about this?

Most of you will pay $500,000 in taxes over the next 10 years.

Can you imagine what you could do if you channel some of that towards property investments instead?

[90% of that will be in Future taxes, see Diagram 2 above.]

Not all accountants are created equal. Otherwise, you would not still be reading. Many accountants are not proactive and will not highlight opportunities. Some may try to do so. However, unless they specialise in creating passive income, they will still falter and fail to assist you in the end.

That’s because most of them are not familiar with the different types of trusts and other structures out there to start with. Then, on top of that, they have to have experience how to combine these structures (that they are not familiar with) to produce these passive income streams, using tax dollars.

But when people ask them, these accountants look all glum and say “yes” because they think they know – just because they are accountants. And that is dangerous. This burns their clients badly.

As a result, most find us to be the only ones they can turn to for help.

If that’s you, please don’t hesitate to contact us. Just complete the short form below – and we’ll be in touch – with likely, some great news too.